The ACHP recently approved an exemption (exempted category) that releases all federal agencies from the Section 106 requirement to consider the effects of their undertakings involving the installation and placement of electric vehicle supply equipment (EVSE). Under 36 CFR 800.14(c), the ACHP or an agency official may propose a program or category of undertakings that may be exempted from review under the provisions of Subpart B of the Section 106 regulations.

Background

Several sections within the Infrastructure Investment and Jobs Act (IIJA) of 2021, as well as Executive Orders 14008 and 14057, have committed the federal government to modernize its entire vehicle fleet to electric vehicles, which will necessitate the installation of supply equipment to support their operation. The Department of Homeland Security’s (DHS) Federal Preservation Officer convened a federal work group of several agencies, including representatives of the General Services Administration (GSA) and the U.S. Department of Transportation (DOT), to consider a programmatic solution to address the significant increase in undertakings as a result of these mandates. Given the applicability of these requirements to federal agencies across the government, the ACHP determined it would lead the effort to develop the programmatic solution.

The installation of EVSE is likely to result in minimal or no effects to historic properties when certain conditions are met. Because the EVSE relies on existing electric infrastructure, as well as existing parking structures and areas, minimal ground disturbance will be needed. Further, the equipment itself will either be placed in a way that is minimally visible, or will utilize colors that allow it to blend in. Finally, EVSE can be removed, allowing any effects to be temporary in nature.

The exemption applies to the installation of EVSE on federal, state, and private lands. It does not apply on Tribal lands unless the Tribe agrees in advance to allow the exemption and notifies the ACHP, as required by Appendix A of the exemption.

What is EVSE and Does the Section 106 Exemption Apply?

- EVSE consists of the electrical hardware used to supply electric energy to a plug-in electric vehicle (PEV) in order to charge a PEV’s batteries.

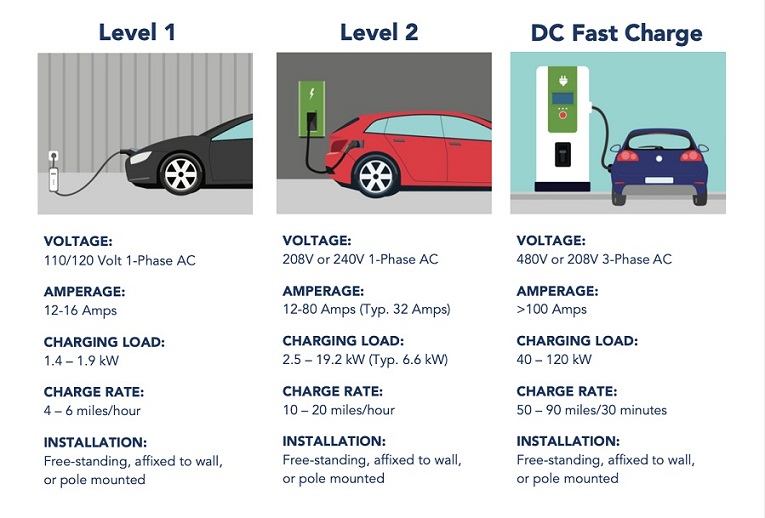

- As illustrated below, the exemption applies to Level 1, 2, and 3 (also known as DC) EVSE for passenger cars and light-duty vehicles installed in existing designated parking areas or structures, utilizing existing electric infrastructure. The exemption applies to wall mount, pole mount, or freestanding EVSE. It does not apply to EVSE which requires the installation of a photovoltaic canopy or solar panels.

- Only minimal changes to a facility’s or location’s distinctive materials, features, spaces, and spatial relationships, including landscapes and streetscapes, can be made.

- EVSE can be removed, ensuring that these nonadverse effects to historic properties are not permanent.

Consultation and Public Participation

A small working group of Federal Preservation Officers assisted the ACHP in developing the initial language for the exemption. Consistent with the regulations, and as the proponent for the exemption, the ACHP conducted consultation with State Historic Preservation Officers (SHPOs), Tribal Historic Preservation Officers (THPOs), Indian tribes, Native Hawaiian organizations, and other consulting parties, as well as ensuring public participation opportunities consistent with the proposed exemption’s scope.

The ACHP hosted consultation meetings with SHPOs, THPOs, Indian tribes, Native Hawaiian organizations, and other consulting parties via Zoom in June 2022. There was general support among consulting parties for the exemption, although questions were raised regarding potential additional conditions to ensure the nonadverse effect threshold would be met during the installation of EVSE. The ACHP then revised the exemption to respond to the comments it received, adding additional detail regarding the exemption’s scope, conditions, and administrative provisions. A second round of consultation occurred in late August 2022. Minor additional comments were received from consulting parties, resulting in minimal modifications to the exemption. Following the completion of consultation, the exemption was submitted to the ACHP for review and approval, which occurred on October 26, 2022.

Public comments on the proposed EVSE exemption were solicited through a Federal Register notice, which was published on May 5, 2022. No comments were received from the public on this effort.

The approved exemption was published in the Federal Register on November 2, 2022.

Questions may be directed to program_alternatives@achp.gov with the subject line “EVSE Exemption.”

Additional Resources

More information about EVSE installation and use can be found in the following federal agency resources.

- Plug-In Electric Vehicle Handbook for Fleet Managers

- Level 1 Electric Vehicle Charging Stations at the Workplace

- Implementing Workplace Charging within Federal Agencies

- Charging Forward: A Toolkit for Planning and Funding Rural Electric Mobility Infrastructure